Timely Filing, What is it?

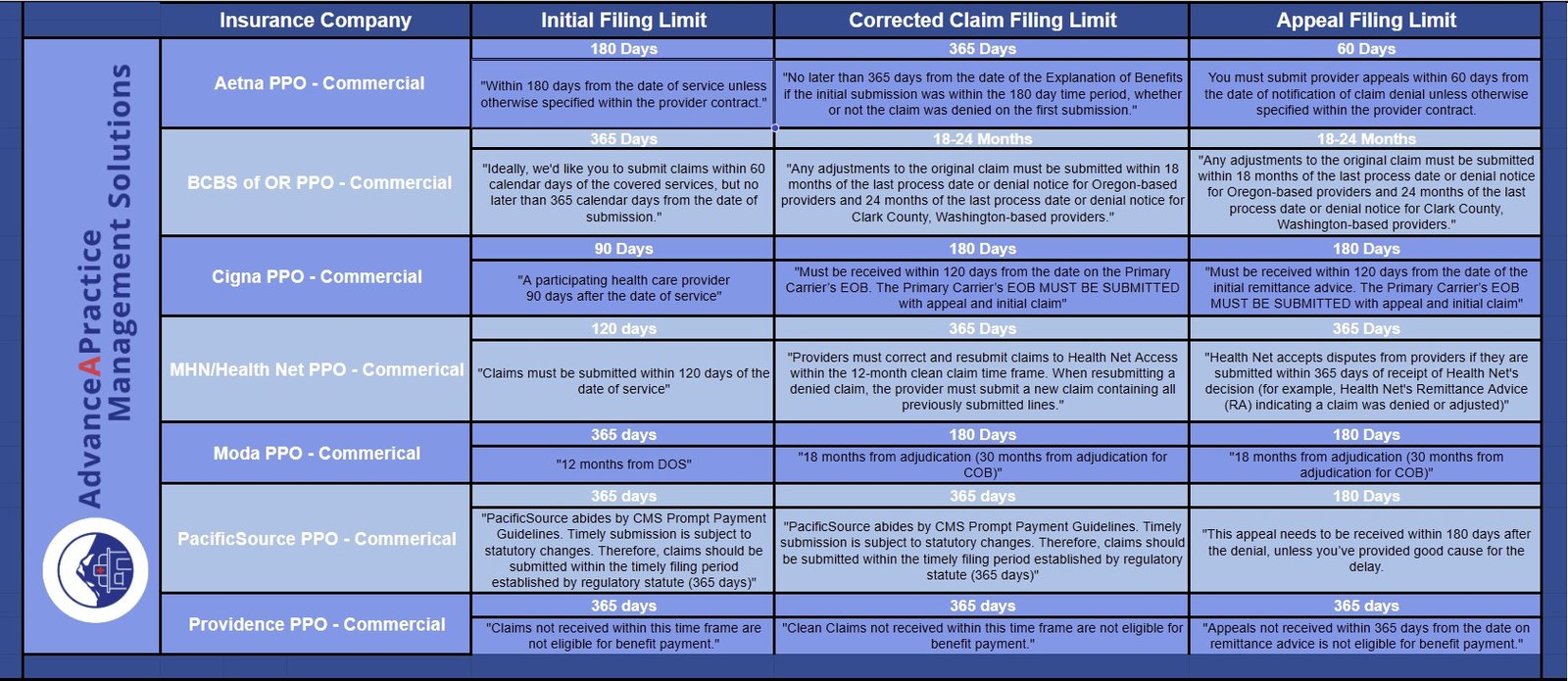

Healthcare providers must adhere to specific timely filing limits to receive payment for their services from health insurance plans. Additionally, the payment will be allowed if the claim is submitted to the insurance company within the stipulated time frame. Moreover, insurance companies have three types of time limits, each with a different time frame.

The first limit is the “Initial” timely filing limit, representing the maximum number of days allowed to submit a claim to an insurance company for services rendered. Notably, this time limit starts from the date of service.

Moving on, the second limit type is the “Corrected Claim” timely filing limit. This refers to the maximum number of days that provider offices have to submit a corrected claim to an insurance company.

Lastly, the “Appeal” timely filing limit starts from the date noted on the denial letter received from the insurance company. Significantly, this time limit is for submitting an appeal to the insurance company to overturn their previous decision to deny payment for service(s).

It’s crucial to verify the claim submissions with a representative or by using the Insurance Payer website to ensure that they are received and documented. Even if the clearinghouse shows that the insurance company received the claim, it still needs to confirm receipt.

For more practice management resources, click here. To explore additional Insights from AdvanceAPractice Management, click here.